SOL Price Prediction: Key Factors and Market Outlook

#SOL

- SOL's technical indicators show mixed signals with potential for both upside and downside.

- Market sentiment is influenced by strategic moves and product launches, creating volatility.

- Investors should watch key price levels and news developments for investment decisions.

SOL Price Prediction

SOL Technical Analysis: Key Indicators to Watch

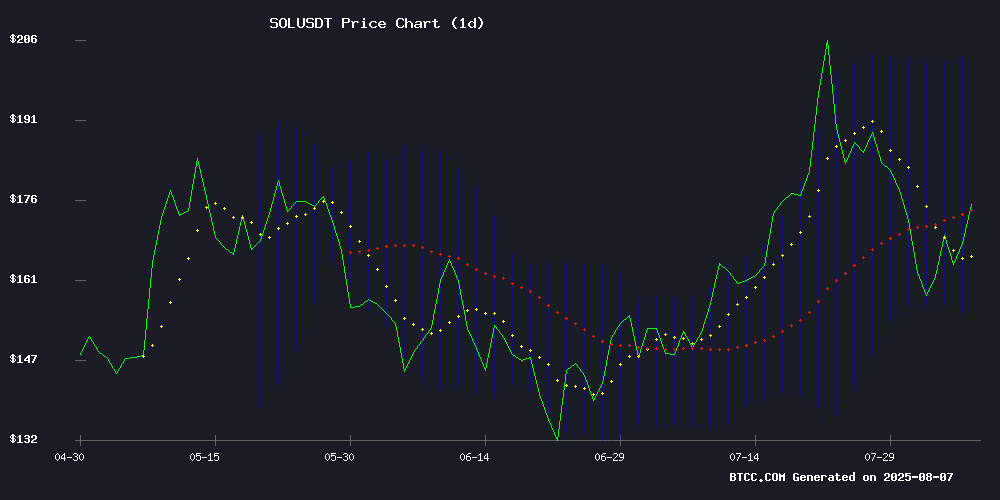

According to BTCC financial analyst Sophia, SOL is currently trading at $170.13, below its 20-day moving average of $178.10, indicating potential short-term bearish pressure. The MACD shows a positive momentum with a value of 9.47, but the Bollinger Bands suggest volatility with the price NEAR the middle band. Sophia notes that a break above the upper band at $201.99 could signal a bullish trend, while a drop below the lower band at $154.21 may indicate further downside.

SOL Market Sentiment: Mixed Signals Amid Strategic Moves

BTCC financial analyst Sophia highlights mixed market sentiment for SOL. Positive developments include Upexi Inc.'s $381M solana treasury and Solana's launch of the 'Seeker' crypto phone. However, Galaxy Digital's $40.7M SOL transfer to Binance and price retreats to $162 introduce caution. Sophia suggests that while bullish patterns like the $340 fractal are noted, bearish signals such as large outflows from Binance could temper optimism.

Factors Influencing SOL’s Price

Upexi Inc. Emerges as Crypto's Newest Heavyweight with $381M Solana Treasury

Upexi Inc. (Nasdaq: UPXI), once known for consumer health products, has rapidly transformed into a crypto powerhouse. The Tampa-based firm recently acquired an additional 83,000 SOL tokens for $16.7 million, bringing its Solana holdings to 1.9 million tokens worth over $381 million.

The company's aggressive crypto strategy began in April when a $100 million investment from trading firm GSR triggered a 700% stock surge. Upexi has since raised $200 million through an innovative capital structure combining traditional equity with SOL-backed convertible notes, distinguishing itself in the growing field of crypto treasury plays.

"Our capital raise structure was designed to maximize shareholder value while responding to market conditions," said Chief Strategy Officer Brian Rudick. The moves signal a broader trend of public companies diversifying beyond Bitcoin into alternative digital assets.

Galaxy Digital Shifts $40.7M in SOL to Binance, Signaling Strategic Pivot

Galaxy Digital has transferred 250,000 SOL tokens—worth $40.7 million—to Binance, marking a notable shift in its crypto asset management strategy. The move, tracked by LookIntoChain, suggests a transition from staking to more active exchange-based strategies like trading or yield farming.

The firm's Q2 2025 financials reveal a stark turnaround: $30.7 million in net profit versus a $295 million loss in Q1. With $691 million in cash reserves as of July 20, Galaxy appears poised for aggressive capital deployment. This liquidity shift may anticipate market volatility or target higher-yield opportunities on centralized platforms.

Staking previously provided passive income, but Binance offers flexibility—whether for leveraged positions, lending, or capturing short-term market movements. The timing aligns with Solana's resurgence as a preferred blockchain for institutional activity.

Solana Eyes $340 as Chart Flashes Bullish Fractal Pattern

Solana's native token SOL shows signs of a potential 118% rally, with technical analysis suggesting a repeat of a 2024 fractal pattern that previously drove prices from $155 to $265. The current $168 price level appears to be consolidating above critical support at $164, with analysts identifying $177 and $189 as key resistance levels to watch.

Market technician Ali Martinez notes the emergence of a Golden Cross pattern, historically a bullish signal that could propel SOL past $200 toward a new all-time high of $340. The MACD histogram's green bars reinforce this outlook, indicating growing bullish momentum despite recent volatility.

Analyst Mary Emerald highlights the $166-$161 zone as a potential springboard for upward movement, drawing parallels to last year's 70% price surge. Traders appear to be accumulating positions, with on-chain data showing strong holder activity throughout the recent uptrend.

Solana Launches Crypto-Native Phone ‘Seeker’ with Hardware Wallet Integration

Solana Mobile has begun global shipments of its second-generation Web3 smartphone, Seeker, with pre-orders surging from 20,000 to over 150,000 units. The device features built-in hardware-level security for private keys, co-developed with Solflare, enabling offline storage and secure on-chain transactions via fingerprint authentication and double-tap confirmations.

A decentralized app store is included, reducing reliance on centralized platforms and aligning with Solana’s vision for permissionless mobile infrastructure. The company plans to introduce a new ecosystem token, SKR, to reward developers and users within the Seeker ecosystem.

Market reaction to the rollout has been positive, with analysts citing growing demand for crypto-native hardware solutions as a key driver. The Seeker’s launch underscores Solana’s push to bridge mobile technology with decentralized finance.

Trollface Creator Criticizes Crypto's Impact on Art Amid $200M Meme Coin Surge

Carlos Ramirez, the artist behind the iconic Trollface meme, has broken a decade-long silence to express his disdain for cryptocurrency's influence on art. In an exclusive interview with Decrypt, Ramirez—known online as Whynne—dismissed the Solana-based Troll meme coin that has surged 1,050% in recent weeks, now ranking as the 32nd largest meme cryptocurrency.

"The money means nothing to me if I can't sell it, but if I sell it, I crash the coin," Ramirez stated, revealing he's repeatedly offered allocations of Trollface-themed tokens. He condemned the arrangement as a "cursed proposition" that could lead to others' financial losses. Despite his earlier apparent promotion of a separate Troll token, Ramirez ruled out legal action against the $200 million project.

The artist's stance highlights growing tensions between crypto's speculative markets and creative authenticity. As meme coins like Troll (SOL) continue attracting speculative capital—with its deployer earning over $64,000—Ramirez's critique underscores how blockchain's profit motives may fundamentally alter digital art's cultural value.

Solana Mobile's Seeker Phone Addresses Criticisms with Upgraded Design

Solana Mobile's latest offering, the Seeker, appears to be a direct response to the criticisms leveled against its predecessor, the Saga. Tech influencer Marques Brownlee (MKBHD) had previously panned the Saga for its high price, mediocre specs, and overly niche crypto features. The Seeker, however, showcases significant improvements, particularly in weight and portability, making it a more appealing option for crypto enthusiasts.

The Seeker's lightweight design is immediately noticeable, addressing one of the Saga's most common complaints. While exact specifications remain undisclosed, the phone feels notably lighter than mainstream competitors like the iPhone. This refinement suggests Solana Mobile is listening to its critics and adapting accordingly.

Priced at $500, the Seeker targets a broader audience, potentially appealing to both crypto natives and general users. With 150,000 units anticipated, the device could serve as a secondary phone for many, though its standalone quality appears competitive for its price range.

Solana (SOL) Retreats to $162 as Bears Target Lower Support Levels

Solana's SOL token has retreated to $161.94, marking a 3.72% decline in the past 24 hours and a 25% drop from its July peak of $206. The sell-off reflects profit-taking after a strong rally earlier this summer, with technical indicators now signaling potential further downside risks.

Network activity shows signs of cooling, with monthly non-vote transactions declining from 1.3 billion in July to 1.1 billion in August. This moderation in blockchain usage coincides with the price weakness, suggesting a broader reassessment of positions among traders.

The Relative Strength Index at 43.42 indicates neutral momentum with bearish undertones. Market uncertainty continues to amplify selling pressure, creating challenging conditions for SOL holders as the cryptocurrency tests key support levels.

Solana’s New Crypto Smartphone Goes Global

Solana is making a bold move beyond the digital realm with its new Seeker smartphone, targeting global adoption across 50 countries. The device ships with 150,000 units already distributed—a stark contrast to its predecessor’s modest 20,000 sales. This isn’t just hardware; it’s a manifesto for Web3 sovereignty, replacing Apple and Google’s dominance with TEEPIN, a decentralized operating system.

The Seeker arrives preloaded with a dApp Store featuring 100+ crypto-native applications, signaling Solana’s ambition to redefine mobile as a decentralized platform. Its economic model hinges on the SKR token, empowering users through participatory governance. 'Seekers officially start shipping today,' Solana Mobile announced on X, marking a pivotal moment for crypto’s physical infiltration into daily life.

Solana (SOL) Price Forecast: Quiet Accumulation Hints at $180+ Rally in August

Solana's price has climbed from $140 to $168 in recent weeks, defying a decline in social media chatter. This divergence suggests accumulation by veteran investors during periods of low hype—a historically bullish signal for SOL.

Technical indicators flash short-term caution, with the MACD turning bearish. Yet critical support at $162.64 remains intact, anchored by the 9-day DEMA. The $165-$167 zone now serves as a litmus test for bullish continuity.

August may open with consolidation, but the inverse correlation between price and social volume suggests room for upward movement. Santiment data reveals social dominance at just 4.57%, mirroring Q2 patterns where quiet spells preceded gradual gains.

Solana Price Prediction: SOL Faces $120 Test Amid Binance’s Large SOL Outflows

Solana's market dynamics are under scrutiny as Binance executes significant SOL transfers, sparking speculation about underlying motives. The movement of millions in SOL from Binance's hot wallets, while not conclusively bearish, signals a potential shift in exchange strategy or ecosystem sentiment.

Despite the uncertainty, SOL demonstrates resilience above critical support levels. The $126-$133 Fibonacci zone has emerged as a pivotal area, with technical indicators suggesting possible upward momentum if holding firm.

Solana Price Prediction: More Consolidation Expected As New Altcoin Hype Overshadows SOL

Solana's price action shows signs of prolonged consolidation, deviating from its historical role as a leader in altcoin rallies. Meanwhile, emerging projects like Remittix are capturing market attention with innovative payment ecosystems and aggressive presale growth.

Remittix positions itself as a potential disruptor in blockchain-based payments, addressing scalability and interoperability challenges that even Solana's robust network has yet to fully resolve. The project's PayFi ecosystem promises tangible improvements over existing solutions, though SOL maintains technical advantages in transaction throughput.

Is SOL a good investment?

BTCC financial analyst Sophia provides a nuanced view on SOL as an investment. Below is a summary of key factors:

| Factor | Details |

|---|---|

| Technical Indicators | Current price below 20-day MA, MACD positive but Bollinger Bands suggest volatility. |

| Market Sentiment | Mixed with strategic moves like Upexi's treasury and Galaxy Digital's outflow. |

| Price Targets | Potential rally to $180+ or test of $120 support. |

Sophia advises monitoring both technical levels and news flow for clearer signals.